D. K. Goel (Volume-1)Class-12 Text Book Solutions

Chapter -1

Accounting For Partnership Firms – Fundamentals

SOLUTION : 12.

PROFIT AND LOSS APPROPRIATION ACCOUNT

Dr. for the year ended 31st March, 2016 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Salary

|

|

|

By Profit & Loss A/c

|

|

|

A 600 x 12

|

7,200

|

|

(Profit for the year)

|

1,72,000

|

|

B 400 x 12

|

4,800

|

12,000

|

By Interest on Drawings

|

|

|

To Commission to C

|

|

|

(4% on annual drawings)

|

|

|

(5% on 1,60,000)

|

|

8,000

|

B 400

|

|

|

To Interest on Capital:

|

|

|

C 600

|

1,000

|

|

A

|

6,000

|

|

|

|

|

B

|

12,000

|

|

|

|

|

C

|

18,000

|

36,000

|

|

|

|

To Profit transferred to :

|

|

|

|

|

|

A’s Current A/c

|

39,000

|

|

|

|

|

B’s Current A/c

|

39,000

|

|

|

|

|

C’s Current A/c

|

39,000

|

1,17,000

|

|

|

|

|

|

1,73,000

|

|

1,73,000

|

Note: Since 4% interest is to be charged on annual drawings, it will be charged for full year instead of six months.

SOLUTION: 13.

PARTNER’S CAPITAL ACCOUNTS

Dr. Cr.

|

Date

|

Particulars

|

A

|

B

|

C

|

Date

|

Particulars

|

A

|

B

|

C

|

|

2017

Mar. 31

|

|

`

|

`

|

`

|

2016

|

|

`

|

`

|

`

|

|

To Balance

|

|

|

|

April 1

|

By Bank

|

|

|

|

|

|

|

|

|

A/c

|

10,00,000

|

8,00,000

|

5,00,000

|

|

|

c/d

|

12,53,000

|

10,53,000

|

7,53,000

|

2017

|

|

|

|

|

|

|

|

|

|

|

Mar. 31

|

By P&L

|

|

|

|

|

|

|

|

|

|

|

Appr.

|

|

|

|

|

|

|

|

|

|

|

A/c

|

2,53,000

|

2,53,000

|

2,53,000

|

|

|

|

12,53,000

|

10,53,000

|

7,53,000

|

|

|

12,53,000

|

10,53,000

|

7,53,000

|

Dr. B’s LOAN ACCOUNT Cr.

|

Date

|

Particulars

|

`

|

Date

|

Particulars

|

`

|

|

2017 March 31

|

To Balance c/d

|

2,09,000

|

2016 July 1

|

By Bank A/c

|

2,00,000

|

|

|

|

2,09,000

|

2017 March 31

|

By Interest on Loan A/c

|

9,000

2,09,000

|

Dr. C’s LOAN ACCOUNT Cr.

|

Date

|

Particulars

|

`

|

Date

|

Particulars

|

`

|

|

2017 March 31

|

To Balance c/d

|

1,02,000

|

2016 Dec. 1

2017 March 31

|

By Bank A/c

By Interest on Loan A/c

|

1,00,000

2,000

|

|

1,02,000

|

1,02,000

|

Working Notes:

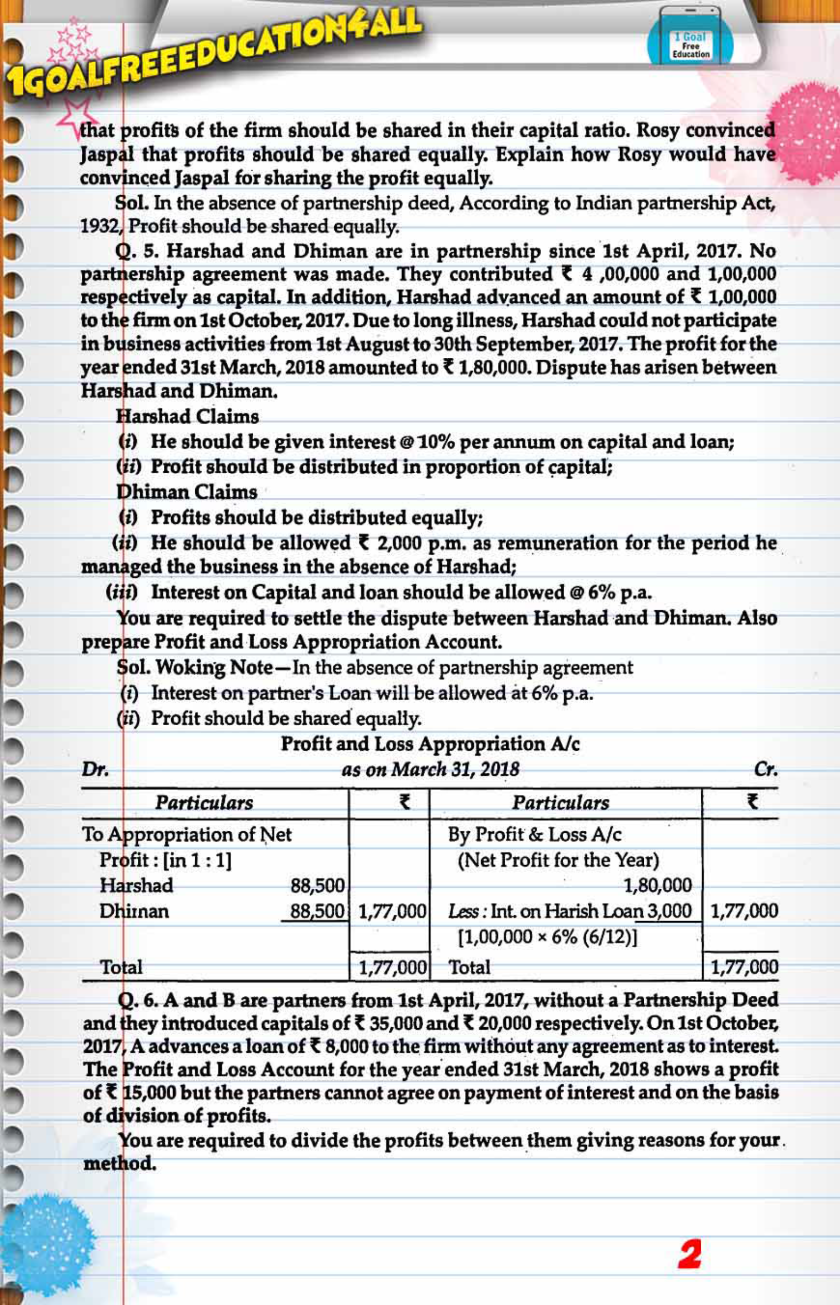

(1) In the absence of agreement, Interest on Loan is to be paid @6% p.a. and profits will be shared equally.

|

|

|

`

|

|

(2) Interest on B’s Loan

|

= 2,00,000 x 6/100 x 9/12

|

= 9,000

|

|

Interest on C’s Loan

|

= 1,00,000 x 6/100 x 4/12

|

= 2,000

|

|

|

Total

|

11,000

|

(3) Net Profit after interest on Loan = `7,70,000 – `11,000 = `7,59,000

(4) Each partner’s share of profit = `7,59,000 ÷ 3 = `2,53,000

SOLUTION : 14.

PROFIT AND LOSS ACCOUNT

Dr. for the year ended 31st March, 2016 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Mamta’s Loan

|

4,800

|

By Profit before interest

|

2,26,440

|

|

To Profit transferred to Profit &

|

|

|

|

|

Loss Appropriation A/c

|

2,21,640

|

|

|

|

|

2,26,440

|

|

2,26,440

|

PROFIT AND LOSS APPROPRIATION ACCOUNT

Dr. for the year ended 31st March, 2016 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital:

|

|

|

By Profit & Loss A/c —

|

|

|

|

Lata

|

21,000

|

|

Net Profit

|

|

2,21,640

|

|

Mamta

|

14,000

|

35,000

|

By Interest on Drawings :

|

|

|

|

To Salary (Lata)

|

|

30,000

|

Lata

|

1,440

|

|

|

To General Reserve A/c

|

|

16,000

|

Mamta

|

1,920

|

3,360

|

|

To Profit transferred to :

|

|

|

|

|

|

|

Lata’s Capital A/c

|

1,00,800

|

|

|

|

|

|

Mamta’s Capital A/c

|

43,200

|

1,44,000

|

|

|

|

|

|

|

2,25,000

|

|

|

2,25,000

|

|

Notes: (1) Interest on Mamta’s Loan has been calculated at 6% p.a.

(2) Interest on Drawings has been calculated for an average period of 6 months.

|

|

(3) Distributable Profit =

Total of Credit side

|

2,25,000

|

|

(-) Total of Debit side (35,000 + 30,000)

|

65,000

|

|

General Reserve is 10% of 1,60,000 = 16,000

|

1,60,000

|

SOLUTION : 15.

Case (a) PROFIT AND LOSS ACCOUNT

Dr. for the year ending on 31st March, 2016 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Loan :

|

|

|

By Profit before interest

|

7,500

|

|

A

|

9,000

|

|

By Net Loss transferred to :

|

|

|

B

|

4,500

|

13,500

|

A’s Capital A/c 1,200

B’s Capital A/c 1,800

C’s Capital A/c 3,000

|

6,000

|

|

|

|

13,500

|

|

13,500

|

|

Case (b)

|

PROFIT AND LOSS ACCOUNT

|

|

|

Dr.

|

for the year ending on 31st March, 2016

|

Cr.

|

|

Particulars

|

`

|

Particulars

|

`

|

|

To Loss before interest

|

|

7,500

|

By Net Loss transferred to :

|

|

|

To Interest on Loan:

|

|

|

A’s Capital A/c 4,200

|

|

|

A

|

9,000

|

|

B’s Capital A/c 6,300

|

|

|

B

|

4,500

|

13,500

|

C’s Capital A/c 10,500

|

21,000

|

|

|

|

21,000

|

|

21,000

|

Notes: (i) Interest on A’s Loan = `2,00,000 x 6/100 x 9/12 = `9,000

Interest on B’s Loan = `1,00,000 x 6/100 x 9/12 = `4,500

SOLUTION : 16.

PROFIT AND LOSS APPROPRIATION ACCOUNT

Dr. for the year ended 31st March, 2015 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capitals :

|

|

|

By Profit & Loss A/c

|

|

|

P

|

40,000

|

|

Net Profit (`7,60,000

|

|

|

Q

|

24,000

|

64,000

|

—Rent `2,40,000)

|

5,20,000

|

|

To Q’s Salary

|

|

60,000

|

|

|

|

To Commission: P

|

60,000

|

|

|

|

|

Q

|

16,000

|

76,000

|

|

|

|

To Profit transferred to

|

|

|

|

|

|

P’s Capital A/c

|

1,92,000

|

|

|

|

|

Q’s Capital A/c

|

1,28,000

|

3,20,000

|

|

|

|

|

|

5,20,000

|

|

5,20,000

|

Dr. PARTNER’S CAPITAL ACCOUNTS Cr.

|

Date

|

Particulars

|

P

|

Q

|

Date

|

Particulars

|

P

|

Q

|

|

2015

|

|

`

|

`

|

2014

|

|

`

|

`

|

|

Mar. 31

|

To Drawings

|

40,000

|

30,000

|

Apr. 1

|

By Bal. b/d

|

5,00,000

|

3,00,000

|

|

Mar. 31

|

To Bal. c/d

|

7,52,000

|

4,98,000

|

2015

|

|

|

|

|

|

|

|

|

Mar. 31

|

By Interest on

|

|

|

|

|

|

|

|

|

Capital

|

40,000

|

24,000

|

|

|

|

|

|

Mar. 31

|

By Salary

|

|

60,000

|

|

|

|

|

|

Mar. 31

|

By Commi-

|

|

|

|

|

|

|

|

|

ssion

|

60,000

|

16,000

|

|

|

|

|

|

Mar. 31

|

By P & L App.

|

|

|

|

|

|

|

|

|

A/c (Profit)

|

1,92,000

|

1,28,000

|

|

|

|

7,92,000

|

5,28,000

|

|

|

7,92,000

|

5,28,000

|

Working Notes:

(1) Net Profit transferred from P & L A/c to P & L App. A/c

= `7,60,000 – Rent `2,40,000 = `5,20,000

(2) Net Profit after deducting interest on capitals, salary and P’s commission:

`5,20,000 – `64,000 – `60,000 – `60,000 = 3,36,000

Q’s Commission = 3,36,000 x 5/105 = 16,000

(3) Rent will be credited to Rent Payable Account.

SOLUTION : 17.

PROFIT AND LOSS APPROPRIATION ACCOUNT

Dr. for the year ending on 31st March, 2016 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital:

X 2/3 of45,000 30,000

Y 1/3 of 45,000 15,000

|

45,000

|

By Net Profit as per

Profit & Loss A/c

|

45,000

|

|

45,000

|

45,000

|

|

Working Note:

|

`

|

|

Interest on X’s Capital = 8% on `10,00,000

|

80,000

|

|

Interest on Y’s Capital = 8% on `5,00,000

|

40,000

|

|

|

1,20,000

|

Since available profit is only `45,000 which is less than appropriations of `1,20,000, profit will be distributed in the ratio of appropriations as follows :

Interest on Capital 80,000 : 40,000

or 2 : 1

SOLUTION : 18.

PROFIT AND LOSS APPROPRIATION ACCOUNT

Dr. for the year ended 31st March, 2014 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Transfer to Reserves

|

|

8,000

|

By Profit and Loss A/c

|

80,000

|

|

|

To Interest on Capitals :

|

|

|

Less : Interest on Puja’s

|

|

|

|

Pooja

|

7,000

|

|

Loan (20,000 x 6/100

|

|

|

Archna

|

3,000

|

10,000

|

x 5/12)

|

500

|

79,500

|

|

To Profit transferred to :

|

|

|

By Interest on drawings

|

|

|

|

Pooja’s Current A/c

|

41,280

|

|

Pooja

|

240

|

|

|

Archna’s Current A/c

|

20,640

|

61,920

|

Archna

|

180

|

420

|

|

|

|

79,920

|

|

|

79,920

|

|

Dr.

|

CURRENT ACCOUNTS

|

|

Cr.

|

|

Particulars

|

Pooja

|

Archna

|

Particulars

|

Pooja

|

Archna

|

|

1.4.2013

|

`

|

`

|

1.4.2013

|

`

|

`

|

|

To Balance b/d

|

—

|

23,000

|

By Balance b/d

|

5,000

|

—

|

|

31.3.2014

|

|

|

31.3.2014

|

|

|

|

To Drawings

|

4,800

|

3,600

|

By Interest on Capital

|

7,000

|

3,000

|

|

To Interest on Drawings

|

240

|

180

|

By Profit and Loss

|

|

|

|

To Balance c/d

|

48,240

|

—

|

Appropriation A/c

|

41,280

|

20,640

|

|

|

|

|

By Balance c/d

|

—

|

3,140

|

|

|

53,280

|

26,780

|

|

53,280

|

26,780

|

Note: Interest on Loan is not recorded in the Current Account.

Interest on Drawings

SOLUTION : 19 (A).

(i) SIMPLE METHOD

|

Date

|

|

Amount

`

|

Period

(Months upto March 31)

|

Interest @ 9%

`

|

|

|

|

|

April

|

30

|

8,000

|

11

|

660

|

|

June

|

30

|

6,000

|

9

|

405

|

|

September

|

30

|

5,000

|

6

|

225

|

|

December

|

31

|

12,000

|

3

|

270

|

|

January

|

31

|

10,000

|

2

|

150

|

|

|

|

41,000

|

|

1,710

|

|

(ii)

|

|

PRODUCT METHOD

|

|

|

Date

|

|

Amount

|

Period

|

Products

|

|

|

|

`

|

(Months upto March 31)

|

|

|

April

|

30

|

8,000

|

11

|

88,000

|

|

June

|

30

|

6,000

|

9

|

54,000

|

|

September

|

30

|

5,000

|

6

|

30,000

|

|

December

|

31

|

12,000

|

3

|

36,000

|

|

January

|

31

|

10,000

|

2

|

20,000

|

|

|

|

41,000

|

|

2,28,000

|

Interest = Total of Products x 9/100 x 1/12

= 2,28,000 x 9/100 x 1/12 = `1,710

SOLUTION : 19 (B).

(i) SIMPLE METHOD

|

Date

|

Amount

|

Period

|

Interest @ 10%

|

|

|

`

|

(Months upto March 31)

|

`

|

|

1st June

|

1,000

|

10

|

83

|

|

1st August

|

750

|

8

|

50

|

|

1st October

|

1,250

|

6

|

63

|

|

1st December

|

500

|

4

|

17

|

|

1st February

|

500

|

2

|

8

|

|

|

4,000

|

|

221

|

|

(ii)

|

PRODUCT METHOD

|

|

|

Date

|

Amount

|

Period

|

Products

|

|

|

`

|

(Months upto March 31)

|

|

|

1st June

|

1,000

|

10

|

10,000

|

|

1st August

|

750

|

8

|

6,000

|

|

1st October

|

1,250

|

6

|

7,500

|

|

1st December

|

500

|

4

|

2,000

|

|

1st February

|

500

|

2

|

1,000

|

|

4,000

|

|

26,500

|

Interest = Total of Products x 10/100 x 1/12

= 26,500 x 10/100 x 1/12 = `221

SOLUTION: 20 (A).

Gopal withdrew `1,000 p.m. regularly on the first day of every month during the year ended 31st March, 2014 for personal expenses. His interest on drawings will be calculated as follows:

12,000 x 15/100 x 6.5/12 = `975

SOLUTION: 20 (B).

(i) The interest on drawings of X who draws at the beginning of every month is:

48,000 x 9/100 x 6.5/12 = `2,340

(ii) The interest on drawings of Y who draws at the end of every month is:

48,000 x 9/100 x 5.5/12 = `1,980

(iii) The interest on drawings of Z who draws in the middle of every month is:

48,000 x 9/100 x 6/12 = `2,160

|

SOLUTION : 21.

|

|

|

Case (i)

|

Total Drawings for the year = `5,000 x 4

|

= `20,000

|

|

|

Average Period = (12 months + 3 months) ÷ 2

|

= 7.5 months

|

|

|

Interest on Drawings = `20,000 x 8/100 x 7.5/12

|

= `1,000

|

|

Case (ii)

|

Total Drawings for the year = `6,000 x 4

|

= `24,000

|

|

|

Average Period = (9 months + 0 month) ÷ 2

|

= 4.5 months

|

|

|

Interest on Drawings = `24,000 x 8/100 x 4.5/12

|

= `720

|

|

Case (iii)

|

Total Drawings for the year = `10,000 x 4

|

= `40,000

|

|

|

Average Period = (10.5 months + 1.5 months) ÷ 2

|

= 6 months

|

|

|

Interest on Drawings = `40,000 x 8/100 x 6/12

|

= ` 1,600

|

SOLUTION: 22.

Case (i) Average Period = (12 months +1 months)/2 = 6 ½ months

Interest on Drawings = `48,000 x 9/100 x 6.5/12 = `2,340

Case (ii) Average Period = (11 months + 0 months)/2 = 5 ½ months

Interest on Drawings = `60,000 x 9/100 x 5.5/12 = `2,475

Case (iii) Assuming that the drawings were made in the middle of every month:

Average Period = (11.5 months+ 0.5 month)/2 = 6 months

Interest on Drawings = `72,000 x 9/100 x 6/12 = `3,240

Case (iv) As the date of drawing is not given, interest will be calculated for an average period of 6 months.

Interest on Drawings = `72,000 x 9/100 x 6/12 = `3,240

Case (v)

|

Date

|

Amount of Drawings

`

|

Period (Months upto 31st March, 2007)

|

Products

`

|

|

30th April, 2015

|

10,000

|

11

|

1,10,000

|

|

1st July, 2015

|

15,000

|

9

|

1,35,000

|

|

1st Oct., 2015

|

18,000

|

6

|

1,08,000

|

|

30th Nov., 2015

|

12,000

|

4

|

48,000

|

|

31st March, 2016

|

20,000

|

0

|

—

|

|

|

|

|

4,01,000

|

|

Interest on Drawings = `4,01,000 x 9/100 x 1/12 = `3,008

|

|

Case (vi)

|

Average Period =

(12 months+ 3 months)/2

|

= 7 ½ months

|

|

|

Total Drawings for the year = `12,000 x 4

|

= `48,000

|

|

|

Interest on Drawings = `48,000 x 9/100 x 7.5/12

|

= `2,700

|

|

Case (vii)

|

Average Period = (9 months + 0 month)/2

|

= 4 ½ months

|

|

|

Total Drawings for the year = `18,000 x 4

|

= `72,000

|

|

|

Interest on Drawings = `72,000 x 9/100 x 4.5/12

|

= `2,430

|

|

Case (viii)

|

Average Period = (10.5 months + 1.5 months)/2

|

= 6 months

|

|

|

Total Drawings for the year = `18,000 x 4

|

= `72,000

|

|

|

Interest on Drawings = `72,000 x 9/100 x 6/12

|

= `3,240

|

SOLUTION : 23 (A).

Gupta withdraws `800 at the beginning of every month for the six months ending 30th September, 2013. Hence, his drawings for the period of six months would be:

Total drawings = 6 x `800 = `4,800.

(Time left after first drawing + Time left after last drawing)/2

= (6 + 1)/2 = 3.5 months.

4,800 x 15/100 x 3.5/12 = `210

SOLUTION : 23 (B).

Gupta withdraws `800 at the end of every month for the six months ending 30th September, 2013.

Total drawings = 6 x `800 = `4,800

(Time left after first drawing + Time left after last drawing)/2

= (5 + 0)/2 = 2.5 months.

4,800 x 15/100 x 2.5/12 = `150

SOLUTION : 23 (C).

Total Drawings of A = `15,000 x 6 = ` 90,000

Total Drawings of B = `20,000 x 6 = `1,20,000

Total Drawings of C = `25,000 x 6 = `1,50,000

|

|

A

|

B

|

C

|

|

Average Period

|

(6+1)/2 = 3.5 months

|

(5 + 0)/2 = 2.5 months

|

(5.5 + 0.5)/2 = 3 months

|

|

Interest on Drawings

|

`90,000 x 10/100 x 3.5/12 = `2,625

|

`1,20,000 x 10/100 x 2.5/12 = `2,500

|

`1,50,000 x 10/100 x 3/12 = `3,750

|

|

|

SOLUTION : 24 (A).

Total Drawings = `10,000 x 9 months = `90,000

Average Period = (9 months + 1 month)/2 = 5 months

Interest on Drawings = `90,000 x 9/100 x 5/12 = `3,375

SOLUTION : 24 (B).

Total Drawings = `10,000 x 9 months = `90,000

Average Period = (8 months + 0 month)/2 = 4 months

Interest on Drawings = `90,000 x 9/100 x 4/12 = `2,700

SOLUTION : 24 (C).

Total Drawings = `10,000 x 9 months = `90,000

Average Period = (8.5 months + 0.5 month)/2 = 4.5 months

Interest on Drawings = `90,000 x 9/100 x 4.5/2 = `3,038

SOLUTION : 25.

Case (i) Interest on Drawings = `60,000 x 8/100 x 6/12= `2,400

Case (ii) Since rate of interest is 8% and not 8% p.a. interest will be calculated for 12 months:

Interest on Drawings = `60,000 x 8/100 = `4,800

SOLUTION : 26.

PROFIT AND LOSS APPROPRIATION ACCOUNT

|

Dr. For the year ended 31st March. 2014

|

|

Cr.

|

|

Particulars

|

`

|

Particulars

|

`

|

|

To Salary to Amit

|

|

18,000

|

By Profit & Loss A/c

|

|

74,040

|

|

To Profits transferred to :

|

|

|

By Interest on Drawings :

|

|

|

|

Amit’s Current A/c

|

30,000

|

|

Amit

|

1,560

|

|

|

Nami’s Current A/c

|

20,000

|

|

Namit

|

1,320

|

|

|

Ruchi’s Current A/c

|

10,000

|

60,000

|

Ruchi

|

1,080

|

3,960

|

|

|

|

78,000

|

|

|

78,000

|

Dr. CURRENT ACCOUNTS Cr.

|

Date

|

Particulars

|

Amit

|

Namit

|

Ruchi

|

Date

|

Particulars

|

Amit

|

Namit

|

Ruchi

|

|

2013

|

|

`

|

`

|

`

|

2013

|

|

`

|

`

|

`

|

|

April 1

|

To Balance

|

|

|

|

April 1

|

By Balance

|

|

|

|

|

|

b/d

|

—

|

—

|

1,000

|

|

b/d

|

5,000

|

2,000

|

—

|

|

2014

|

|

|

|

|

2014

|

|

|

|

|

|

March

|

To Dra-

|

|

|

|

March

|

By Salary

|

18,000

|

—

|

—

|

|

31

|

wings

To Interest

|

24,000

|

24,000

|

24,000

|

31

|

By P & L

|

|

|

|

|

|

on Dra-

|

|

|

|

|

Appro-

|

|

|

|

|

|

Wings(1)

|

1,560

|

1,320

|

1,080

|

|

priation

A/c

|

30,000

|

20,000

|

10,000

|

|

|

To Balance

|

|

|

|

|

By Balance

|

|

|

|

|

|

c/d

|

27,440

|

—

|

—

|

|

c/d

|

—

|

3,320

|

16,080

|

|

|

|

53,000

|

25,320

|

26,080

|

|

|

53,000

|

25,320

|

26,080

|

(1) Calculation of Interest on Drawings:

Amit withdraws on the First day of each month

24,000 x 12/100 x 6.5/12 = `1,560

Namit withdraws on the last date of each month

24,000 x 12/100 x 5.5/12 = `1,320

Ruchi withdraws at the end of each quarter:

Average Period = (9 months + 0 month)/2 = 4.5 months

Interest on Drawings = 24,000 x 12/100 = `1,080

SOLUTION : 27.

JOURNAL

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

2016 Jan. 1

|

Q’s Capital A/c

To Bank A/c

(Withdrawal by 0 out of Capital)

|

Dr.

|

|

1,20,000

|

1,20,000

|

|

March 31

|

Profit and Loss A/c

To Profit and Loss Appropriation A/c

(The transfer of profit to Profit and Loss Appropriation A/c)

|

Dr.

|

|

4,30,000

|

4,30,000

|

|

March 31

|

Interest on Capital A/c

To P’s Capital A/c

To Q’s Capital A/c

(Interest on partner’s capitals)

|

Dr.

|

|

1,27,000

|

80,000

47,000

|

|

|

Profit and Loss Appropriation A/c Dr.

To Interest on Capital A/c

(Transfer of interest on Capital to Profit and Loss App. A/c)

|

|

1,27,000

|

1,27,000

|

|

March 31

|

P’s Capital A/c

R’s Capital A/c

To Interest on Drawings A/c

(Interest on partner’s drawings)

|

Dr.

Dr.

|

|

6,600

7,200

|

13,800

|

|

|

Interest on Drawings A/c Dr.

To Profit and Loss Appropriation A/c

(Transfer of interest on drawings to Profit and Loss App. A/c)

|

|

13,800

|

13,800

|

|

March 31

|

Profit and Loss Appropriation A/c

To P’s Capital A/c

To Q’s Capital A/c

To R’s Capital A/c

(Transfer of profit to capital accounts)

|

Dr.

|

|

3,16,800

|

1.05.600

1.05.600

1.05.600

|

|

Dr.

|

PARTNER’S CAPITAL ACCOUNTS

|

Cr.

|

|

Date

|

Particulars

|

P

|

Q

|

R

|

Date

|

Particulars

|

P

|

Q

|

R

|

|

2015

|

|

`

|

`

|

`

|

2015

|

|

`

|

`

|

`

|

|

Apr. 1

|

To Bal.

|

|

|

|

Apr. 1

|

By Bal.

|

|

|

|

|

|

b/d

|

|

|

20,000

|

|

b/d

|

8,00,000

|

5,00,000

|

|

|

2016

|

|

|

|

|

2016

|

|

|

|

|

|

Jan. 1

|

To Bank

|

|

|

|

Mar. 31

|

By Int.

|

|

|

|

|

|

A/c

|

|

1,20,000

|

|

|

on Capi-

|

|

|

|

|

Mar. 31

|

To Dra-

|

|

|

|

|

tal A/c

|

80,000

|

47,000

|

|

|

|

wings

|

|

|

|

Mar. 31

|

By P&L

|

|

|

|

|

|

A/c

|

1,20,000

|

|

1,20,000

|

|

App. A/c

|

1,05,600

|

1,05,600

|

1,05,600

|

|

Mar. 31

|

To Int.

|

|

|

|

Mar. 31

|

By Bal.

|

|

|

|

|

|

on

|

|

|

|

|

c/d

|

|

|

41,600

|

|

|

Drawin-

|

|

|

|

|

|

|

|

|

|

|

gs A/c

|

6,600

|

|

7,200

|

|

|

|

|

|

Mar. 31

|

To Bal.

|

|

|

|

|

|

|

|

|

|

c/d

|

8,59,000

|

5,32,600

|

|

|

|

|

|

|

|

|

9,85,600

|

6,52,600

|

1,47,200

|

|

|

9,85,600

|

6,52,600

|

1,47,200 |

Working Notes:

|

(1)

|

Interest on Q’s Capital:

|

`

|

|

|

On `5,00,000 for 9 months : 5,00,000 x 10/100 x 9/12

|

37,500

|

|

|

On `3,80,000 for 3 months : 3,80,000 x 10/100 x 3/12

|

9,500

|

|

|

|

47,000

|

|

(2)

|

Interest on drawings:

|

|

|

|

P’s Drawings : `10,000 x 12 = `1,20,000 x 12/100 x 5.5/12 =

|

6,600

|

|

|

R’s Drawings : `1,20,000 x 12/100 x 6/12 =

|

7,200

|

Note : In the absence of actual dates of drawings of/?, interest thereon has been

calculated for the average period i.e. 6 months.

(3) Divisible Profit =

`4,30,000 – Interest on Capital `1,27,000 + Interest on Drawings `13,800 = `3,16,800

Each Partner’s share = `3,16,800 ÷ 3 = `1,05,600

SOLUTION : 28.

Books of Active, Blunt and Circle

Profit & loss Appropriation A/c

Dr. for the year ended 31st March, 2015 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital :

|

|

|

By Profit & Loss A/c

|

|

|

|

Active

|

|

27,000

|

|

(Net Profit for the year)

|

5,93,120

|

|

Blunt

|

|

36,000

|

|

By Interest on Drawings :

|

|

|

|

Circle

|

|

21,000

|

84,000

|

Active 60,000 x 6/100 x 6.5/12

Blunt 84,000 x 6/100 x 5.5/12

Circle 80,000 x 6/100 x 6/12

|

= 1,950

= 2,310

= 2,400

|

6,660

|

|

To Salary’ :

Blunt

|

|

72,000

|

|

|

Circle

To Commission (Note 1)

|

48,000

|

1,20,000

|

|

Blunt

|

|

17,990

|

|

|

|

|

|

|

Circle

|

|

17,990

|

35,980

|

|

|

|

|

|

To Profit Transferred to :

|

|

|

|

|

|

|

|

(Note 2)

|

|

|

|

|

|

|

|

|

Active’s Current A/c 1,34,900

|

|

|

|

|

|

|

Blunt’s Current A/c

|

1,04,967

|

|

|

|

|

|

|

Circle’s Current A/c 1,19,933

|

3,59,800

|

|

|

|

|

|

|

|

|

5,99,780

|

|

|

|

5,99,780

|

|

Dr.

|

|

PARTNERS CURRENT ACCOUNTS

|

|

Cr.

|

|

Particulars

|

Active

|

Blunt

|

Circle

|

Particulars

|

Active

|

Blunt

|

Circle

|

|

To Drawings

|

`

60,000

|

`

84,000

|

`

80,000

|

By Int. on

|

`

|

`

|

`

|

|

To Int. on Dra-

|

|

|

|

Capital

|

27,000

|

36,000

|

21,000

|

|

wings

|

1,950

|

2,310

|

2,400

|

By Salary

|

|

72,000

|

48,000

|

|

To Bal. c/d

|

99,950

|

1,44,647

|

1,24,523

|

By Commission

By P & L App.

|

|

17,990

|

17,990

|

|

|

|

|

|

A/c

|

1,34,900

|

1,04,967

|

1,19,933

|

|

|

1,61,900

|

2,30,957

|

2,06,923

|

|

1,61,900

|

2,30,957

|

2,06,923

|

Working Note:

(1) Balance of Profit: `5,93,120 + 6,660 – 84,000 – 1,20,000 = `3,95,780

Commission to Blunt and Circle is 5% to each partner after charging such commission. Hence, the commission will be 5/110 to each partner.

Commission to Blunt = 3,95,780 x 5/110 = `17,990

Commission to Circle = 3,95,780 x 5/110 = `17,990

Divisible Profit: `3,95,780 – 17,990 – 17,990 = `3,59,800

|

|

Active

|

Blunt

|

Circle

|

|

|

|

`

|

`

|

`

|

|

|

Upto `2,70,000

Equally `3,59,800 – 2,70,000 = `89,800

in 1/2 : 1/6 : 1/3

|

90,000

|

90,000

|

90,000

|

|

|

|

|

|

|

|

44,900

|

14,967

|

29,933

|

|

|

|

|

|

|

1,34,900

|

1,04,967

|

1,19,933

|

|

SOLUTION : 29.

Interest on Capitals:

A = `3,00,000 x 10% = `30,000

B = `2,00,000 x 10% = `20,000

A

|

Date

|

Amount

|

Period

|

Products

|

|

|

`

|

|

`

|

|

30. 6.2012

|

20,000

|

9 months

|

1,80,000

|

|

31. 7.2012

|

10,000

|

8 months

|

80,000

|

|

1.10.2012

|

10,000

|

6 months

|

60,000

|

|

1. 3.2013

|

16,000

|

1 month

|

16,000

|

|

Total

|

3,36,000

|

A’s Interest on Drawing = Total of Products/12 x Rate of Interest/100

A = 3,36,000/12 x 10/100 = `2,800

B’s Interest on Drawings = B withdraws `6,000 at the end of each month thus interest

on his drawings would be :

72,000 x 10/100 x 5.5/12 = `3,300

Interest on Capital

SOLUTION : 30.

Case (i)

Dr. PROFIT AND LOSS APPROPRIATION A/C Cr.

|

Particulars

|

|

`

|

Particulars

|

`

|

|

To Profit transferred to :

X 2/3

|

6,000

|

|

By Profit & Loss A/c (Profit for the year)

|

9,000

|

|

Y 1/3

|

3,000

|

9,000

9,000

|

|

9,000

|

Case (ii)

Dr. PROFIT AND LOSS APPROPRIATION A/C Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Profit & Loss A/c

|

|

|

By Loss transferred to :

|

|

|

|

(Loss for the year)

|

|

6,000

|

X 2/3

|

4,000

|

|

|

|

|

|

Y 1/3

|

2,000

|

6,000

|

|

|

|

6,000

|

|

|

6,000

|

|

Case (iii)

Dr. PROFIT AND LOSS APPROPRIATION A/C

|

|

Cr.

|

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital :

|

|

|

By Profit & Loss A/c

|

|

9,000

|

|

X

|

3,000

|

|

(Profit for the year)

|

|

|

|

Y

|

1,800

|

4,800

|

|

|

|

|

To Profit transferred to :

|

|

|

|

|

|

|

X 2/3

|

2,800

|

|

|

|

|

|

Y 1/3

|

1,400

|

4,200

|

|

|

|

|

|

|

9,000

|

|

|

9,000

|

|

Case (iv)

Dr. PROFIT AND LOSS APPROPRIATION A/C

|

|

Cr.

|

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital:

|

|

|

By Profit & Loss A/c

|

|

3,000

|

|

X 3,000 x 5/8

|

|

1,875

|

(Profit for the year)

|

|

|

|

Y 3,000 x 3/8

|

|

1,125

|

|

|

|

|

|

|

3,000

|

|

|

3,000

|

Note : The available profit is `3,000 whereas the interest due on capitals is `4,800 {i.e., `3,000 + `1,800). Since the profit is less than the interest, the available profit will be distributed in the ratio of interest i.e., 3,000 : 1,800 or 5 : 3.

Case (v)

Dr. PROFIT AND LOSS A/C* Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital :

|

|

|

By Profit & Loss A/c

|

|

3,000

|

|

X

Y

|

3,000

1,800

|

|

(Profit for the year)

|

|

|

|

4,800

|

By Loss transferred to :

|

|

|

|

|

|

|

X 2/3

|

1,200

|

|

|

|

|

|

Y 1/3

|

600

|

1,800

|

|

|

|

4,800

|

|

|

4,800

|

*Since Interest on Capital is to be allowed even if firm incurs loss, it is debited to P&L A/c and not to P&L Appropriation A/c.

SOLUTION : 31.

(Case I)

Dr. PROFIT AND LOSS APPROPRIATION A/C Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital

A 42,000 x 4/7

B 42,000 x 3/7

|

24,000

18,000

|

By Profit & Loss Account

|

42,000

|

|

42,000

|

42,000

|

Note: The available profit is `42,000 whereas the interest due on capitals is `56,000 (i.e., `32,000 + `24,000). Since the profit is less than the interest, the available profit will be distributed in the ratio of interest i.e., 32,000 : 24,000 or 4 : 3.

(Case II)

Dr. PROFIT AND LOSS A/C Cr.

|

Particulars

|

|

|

Particulars

|

|

|

|

To Interest on Capital

A

|

32,000

|

|

By Profit & Loss Account By Loss Transferred to :

|

|

42,000

|

|

B

|

24,000

|

56,000

56,000

|

A 3/5

B 2/5

|

8,400

5,600

|

14,000

56,000

|

SOLUTION : 32.

In the Books of Brij and Nandan

PROFIT AND LOSS APPROPRIATION ACCOUNT

Dr. for the year ended 31st March, 2014 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital

Brij’s Capital A/c

2,00,000 x 2/5 = 80,000

Nandan’s Capital A/c

2,00,000 x 3/5 = 1,20,000

|

2,00,000

|

By Profit & Loss A/c

(Net Profit)

|

2,00,000

|

|

|

2,00,000

|

|

2,00,000

|

Working Notes:

Interest on capital of Brij = `1,20,000

Interest on capital of Nandan = `1,80,000

3,00,000

The available profit is `2,00,000, whereas interest due on capitals is `3,00,000. Since the profit is less than interest, the available profit will be distributed amongst the partners in the ratio of their interest on capital i.e., 1,20,000 : 1,80,000 or 12 : 18 or 2 : 3.

SOLUTION : 33.

Case (i)

Dr. PROFIT AND LOSS ACCOUNT Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital :

Kavita

Leela

To Profit transferred

to Profit & Loss App. A/c

|

48,000

32,000

|

80,000

30,000

|

By Profit before interest

|

1,10,000

|

|

|

|

1,10,000

|

|

1,10,000

|

Dr. PROFIT AND LOSS APPROPRIATION ACCOUNT Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Profit transferred to :

|

|

By Profit & Loss A/c

|

30,000

|

|

Kavita’s Capital A/c

|

|

|

|

|

|

(2/3)

|

20,000

|

|

|

|

|

Leela’s Capital A/c

|

|

|

|

|

|

(1/3)

|

10,000

|

30,000

|

|

|

|

|

|

30,000

|

|

30,000

|

Case (ii)

Dr. PROFIT AND LOSS ACCOUNT Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Interest on Capital:

|

|

|

By Profit before interest

|

|

35,000

|

|

Kavita

|

48,000

|

|

By Loss transferred to :

|

|

|

|

Leela

|

32,000

|

80,000

|

Kavita’s Capital A/c

|

|

|

|

|

|

|

(2/3)

|

30,000

|

|

|

|

|

|

Leela’s Capital A/c

|

|

|

|

|

|

|

(1/3)

|

15,000

|

45,000

|

|

|

|

80,000

|

|

|

80,000

|

|

Case (iii)

|

|

|

|

|

|

|

Dr.

|

PROFIT AND LOSS ACCOUNT

|

|

Cr.

|

|

Particulars

|

`

|

Particulars

|

`

|

|

To Loss before interest

|

|

10,000

|

By Loss transferred to :

|

|

|

|

To Interest on Capital:

|

|

|

Kavita’s Capital A/c

|

|

|

|

Kavita

|

48,000

|

|

(2/3)

|

60,000

|

|

|

Leela

|

32,000

|

80,000

|

Leela’s Capital A/c

|

|

|

|

|

|

|

(1/3)

|

30,000

|

90,000

|

|

|

|

90,000

|

|

|

90,000

|

SOLUTION : 34.

In the books of Lalan & Balan

PROFIT AND LOSS ACCOUNT

Dr. for the year ended 31st March. 2011 Cr.

|

Particulars

|

|

`

|

Particulars

|

`

|

|

To Interest on Capital*

Lalan’s Current A/c

|

12,000

|

|

By Profit before Interest

By Profit and Loss Appropriation

|

30,000

|

|

Balan’s Current A/c

|

24,000

|

36,000

36,000

|

A/c (Loss transferred)

|

6,000

36,000

|

PROFIT AND LOSS APPROPRIATION ACCOUNT

Dr. for the year ended 31st March. 2011 Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Profit & Loss A/c

|

|

By Interest on Drawings :

|

|

|

(Loss transferred)

|

6,000

|

Lalan’s Current A/c 225

|

|

|

|

|

Balan’s Current A/c 375

|

600

|

|

|

|

By Net Loss transferred to :

|

|

|

|

|

Lalan’s Current A/c 3,240

|

|

|

|

|

Balan’s Current A/c 2,160

|

5,400

|

|

|

6,000

|

|

6,000

|

Note: As the time period of drawings is not given, the interest will be charged for 6 months

Lalan : 3,000 x 15/100 x 6/12 = `225

Balan : 5,000 x 15/100 x 6/12 = `375

*Since Interest on Capital is to be allowed even if firm incurs loss, it is debited to P&L A/c and not to P&L Appropriation A/c.

SOLUTION 35

|

Ratio of effective capital will be calculated as under:—

|

Products

|

|

X: `90,000 for 6 months

|

5,40,000

|

|

`60,000 for 6 months

|

3,60,000

9,00,000

|

|

Y: `75,000 for 4 months

|

3,00,000

|

|

`90,000 for 4 months

|

3,60,000

|

|

`60,000 for 4 months

|

2,40,000

9,00,000

|

|

Z : `75,000 for 7 months

|

5,25,000

|

|

`1,35,000 for 5 months

|

6,75,000

12,00,000

|

Thus the profit sharing ratio would be:

9,00.000 : 9,00.000 : 12.00,000 or 3 : 3 : 4

Dr. PROFIT AND I.OSS APPROPRIATION ACCOUNT Cr.

|

Particulars

|

`

|

Particulars

|

`

|

|

To Profits transferred to :

|

|

By Profit & Loss A/c

|

42,000

|

|

X

|

12,600

|

|

|

|

|

Y

|

12,600

|

|

|

|

|

Z

|

16,800

|

42,000

|

|

|

|

|

|

42,000

|

|

42,000

|

|

|

|

|

|

|

Adjustment in the Closed Accounts

SOLUTION : 36 (A).

|

Interest on A’s Capital of `8,00,000 @ 8%

|

`

64,000

|

|

Interest on B’s Capital of `4,00,000 @ 8%

|

32,000

|

|

Interest on C’s Capital of `3,00,000 @ 8%

|

24,000

|

|

Total Interest to be allowed

|

` 1,20,000

|

This amount of `1,20,000 is an item of expense for the firm but this has not been recorded on the debit side of P & L Appropriation A/c of the previous year. As such the profit of the previous year will be reduced by this amount. Hence, this loss of `1,20,000 will be shared by the partners in their profit sharing ratio, i.e.. 2:1:1

A = `1,20,000 x 2/4 = `60,000

B = `1,20,000 x 1/4 = `30,000

C = `1,20,000 x 1/4 = `30,000

TABLE SHOWING ADJUSTMENT

|

Partner

|

Adjustment

|

Difference

|

|

Dr.

|

Cr.

|

Dr.

|

Cr.

|

|

A

|

60,000

|

64,000

|

|

4,000

|

|

B

|

30.000

|

32,000

|

|

2,000

|

|

C

|

30,000

|

24,000

|

6,000

|

|

JOURNAL ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

|

C’s Capital A/c Dr.

To A’s Capital A/c

To B’s Capital A/c

(Adjustment in respect of interest on capital omitted in previous year’s accounts)

|

|

6,000

|

4,000

2,000

|

SOLUTION: 36 (B).

|

A’s Interest on Capital

|

= `1,20,000 x 5/100 = `6,000

|

|

B’s Interest on Capital

|

= `70,000 x 5/100= `3,500

|

|

C’s Interest on Capital

|

= `50,000 x 5/100 = `2,500

|

TABLE SHOWING ADJUSTMENT

|

Partner

|

Adjustment

|

Difference

|

|

Dr.

|

Cr.

|

Dr.

|

Cr.

|

|

A

|

5,000

|

6,000

|

|

1,000

|

|

B

|

4,000

|

3,500

|

500

|

|

|

C

|

3,000

|

2,500

|

500

|

|

JOURNAL ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

2016

March, 31

|

B’s Capital A/c

C’s Capital A/c

To A’s Capital A/c

(Adjustment in respect of interest on capital omitted in previous year’s accounts)

|

Dr.

Dr.

|

|

500

500

|

1,000

|

|

|

|

|

|

|

SOLUTION : 37.

|

|

|

`

|

|

A

|

8% on `4,00,000 for 2 years

|

= 64,000

|

|

B

|

8% on `6,00,000 for 2 years

|

= 96,000

|

|

C

|

8% on `8,00,000 for 2 years

|

= 1,28,000

|

|

|

|

2,88,000

|

TABLE SHOWING ADJUSTMENT

|

|

A

|

B

|

C

|

Total

|

|

Interest on Capital

|

(Cr.)

|

`

64,000

|

`

96,000

|

`

1,28,000

|

2,88,000

|

|

Division of `2,88,000 in profit

sharing ratio i.e. 1 : 2 : 3 (Dr.)

|

48,000

|

96,000

|

1,44,000

|

2,88,000

|

|

Difference

|

(Cr.) 16,000

|

—

|

(Dr.) 16,000

|

—

|

|

|

|

|

|

|

JOURNAL ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr.( `)

|

Cr.( `)

|

|

2016

March 31

|

C’s Current A/c Dr.

To A’s Current A/c

(Omission of interest on Capital for 2 years rectified)

|

|

16,000

|

16,000

|

SOLUTION: 38.

Interest charged on A’s drawings = `8,000

Interest charged on B’s drawings = `6,000

Interest charged on C’s drawings = `4,000

` 18,000

This amount of `18,000 is an item of income for the firm but this has not been recorded on the credit side of P & L Appropriation A/c of the previous year. As such the profit of the previous year will now be increased by this amount. Hence, this profit of `18,000 will be shared by the partners in their profit sharing ratio of 5 : 3 : 1 which amounts to A `10,000, B `6,000 and C `2,000.

TABLE SHOWING ADJUSTMENTS

|

Partner

|

Adjustment

|

Difference

|

|

Dr.

|

Cr.

|

Dr.

|

Cr.

|

|

A

|

8,000

|

10,000

|

|

2,000

|

|

B

|

6,000

|

6,000

|

|

|

|

C

|

4,000

|

2,000

|

2,000

|

|

JOURNAL ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

|

C’s Capital A/c Dr.

To A’s Capital A/c

(Adjustment for omission of interest on drawings)

|

|

2,000

|

2,000

|

SOLUTION: 39.

|

Calculation of Interest on Drawings :

|

|

|

A : 6% on `20,000 for 6 months

|

`

600

|

|

B : 6% on `24,000 for 6 months

|

720

|

|

C : 6% on `32,000 for 6 months

|

960

|

|

D : 6% on `44,000 for 6 months

|

1,320

|

|

|

3,600

|

TABLE SHOWING ADJUSTMENT

|

|

A

|

B

|

C

|

D

|

Total

|

|

|

`

|

`

|

`

|

`

|

|

|

Interest on Drawings (Dr.) Division of 3,600 in 2 : 2 : 3 : 3

|

600

|

720

|

960

|

1,320

|

3,600

|

|

(Cr.)

|

720

|

720

|

1,080

|

1,080

|

3,600

|

|

Difference

|

Cr. 120

|

—

|

Cr. 120

|

Dr. 240

|

—

|

JOURNAL ENTRY

|

Date

|

Particulars

|

LF.

|

Dr.( `)

|

Cr.( `)

|

|

|

D’s Capital A/c Dr.

To A’s Capital A/c

To C’s Capital A/c

(Omission of interest on drawings, now rectified)

|

|

240

|

120

120

|

SOLUTION : 40.

A’s Drawings = `50,000 x 12 = `6,00,000

Interest on A’s Drawings will be charged for 6.5 months

6,00,000 x 12/100 x 6.5/12 = `39,000

TABLE SHOWING ADJUSTMENT

|

|

|

A

|

B

|

Total

|

|

Interest on Drawings

|

(Dr.)

|

`

39,000

|

`

|

39,000

|

|

Division of `39,000 in 2 : 1

|

(Cr.)

|

26,000

|

13,000

|

|

|

Difference

|

|

Dr. 13,000

|

Cr. 13,000

|

39,000

|

ADJUSTMENT ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

2016 April 1

|

A’s Capital A/c Dr.

To B’s Capital A/c

(Adjustment of Omission of interest on A’s drawings)

|

|

13,000

|

13,000

|

SOLUTION : 41.

TABLE SHOWING ADJUSTMENT

|

|

Anil

|

Sunil

|

Sanjay

|

Total

|

|

|

Cr. (`)

|

Cr. (`)

|

Cr. (`)

|

(`)

|

|

Interest on Capitals @ 10% p.a.

|

|

|

|

|

|

I) for the year ended 31st March 2015

|

80,000

|

70,000

|

30,000

|

1,80,000

|

|

II) for the year ended 31st March 2016

|

80,000

|

70,000

|

30,000

|

1,80,000

|

|

Total Amount Payable (Cr.)

|

1,60,000

|

1,40,000

|

60,000

|

3,60,000

|

|

Division of Firm’s loss will be as under :

|

Dr. (`)

|

Dr.( `)

|

Dr.( `)

|

(`)

|

|

I) for the year ended 31st March 2015

|

|

|

|

|

|

in the ratio of 4 : 3 : 2

|

80,000

|

60,000

|

40,000

|

1,80,000

|

|

II) for the year ended 31st March 2016

|

|

|

|

|

|

in the ratio of 3 : 2 : 1

|

90,000

|

60,000

|

30,000

|

1,80,000

|

|

Total Loss (Dr)

|

1,70,000

|

1,20,000

|

70,000

|

3,60,000

|

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

2016 April 1

|

Anil’s Current A/c Dr.

Sanjay’s Current A/c Dr.

To Sunil’s Current A/c

(Adjustment for the omission of two years’ interest on capitals)

|

|

10,000

10,000

|

20,000

|

SOLUTION : 42.

TABLE SHOWING ADJUSTMENTS

|

|

P

|

Q

|

R

|

Total

|

|

|

`

|

`

|

`

|

`

|

|

Interest on Capitals @ 12% p.a.

|

6,000

|

3,600

|

2,400

|

12,000

|

|

Salary to Partners

|

|

6,000

|

—

|

12,000

|

18,000

|

|

Total Amount Payable

Division of firm’s loss of `30,000

|

(Cr.)

|

12,000

|

3,600

|

14,400

|

30,000

|

|

in 2 : 1 : 1

|

(Dr.)

|

15,000

|

7,500

|

7,500

|

30,000

|

|

Net Effect

|

|

(Dr.) 3,000

|

(Dr.) 3,900

|

(Cr.) 6,900

|

|

JOURNAL ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr.( `)

|

Cr.( `)

|

|

2011 April 1

|

P’s Capital A/c Dr.

Q’s Capital A/c Dr.

To R’s Capital A/c

(Adjustment for the omission of interest on capitals and salary)

|

|

3,000

3,900

|

6,900

|

SOLUTION : 43 (A)

TABLE SHOWING ADJUSTMENTS

|

|

A

|

B

|

Total

|

|

|

`

|

`

|

`

|

|

Interest on Capital (Cr.)

|

48,000

|

24,000

|

72,000

|

|

Commission due to B

|

—

|

20,000

|

20,000

|

|

Salary to A

|

50,000

|

—

|

50,000

|

|

|

98,000

|

44,000

|

1,42,000

|

|

Less : Interest on Drawings (Dr.)

|

12,000

|

10,000

|

22,000

|

|

(Cr.)

|

86,000

|

34,000

|

1,20,000

|

|

Division of Firm’s loss of `1,20,000 in 2 : 1 (Dr.)

|

80,000

|

40,000

|

|

|

|

(Cr.) 6,000

|

(Dr.) 6,000

|

—

|

Adjustment Entry:—

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

10th April, 2016

|

B’s Capital A/c

To A’s Capital A/c (Adjustment for omissions)

|

Dr.

|

|

6,000

|

6,000

|

|

|

|

|

|

|

SOLUTION : 43 (B)

TABLE SHOWING ADJUSTMENTS

|

|

|

Kumar

|

Raja

|

Total

|

|

Interest on Capital

|

(Cr.)

|

`

81,000

|

`

36,000

|

`

1,17,000

|

|

Salary

|

(Cr.)

|

50,000

|

36,000

|

86,000

|

|

Division of firm’s loss of `2,03,000 in 7 : 3

|

(Dr.)

|

1,31,000

1,42,100

|

72,000

60,900

|

2,03,000

2,78,000

|

|

Net Effect

|

|

(Dr.) 11,100

|

(Cr.) 11,100

|

—

|

ADJUSTMENT ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr.( `)

|

Cr.( `)

|

|

2007 March 31

|

Kumar’s Current A/c Dr.

To Raja’s Current A/c

(Adjustment for omission of interest on capital and salary)

|

|

11,100

|

11,100

|

SOLUTION : 44.

TABLE SHOWING ADJUSTMENT

|

|

A

|

B

|

C

|

Total

|

|

Salary

Interest on Capital

|

`

24,000

|

`

60,000

15,000

|

`

40,000

6,000

|

`

1,00,000

45,000

|

|

Total amount payable (Cr.)

|

24,000

|

75,000

|

46,000

|

1,45,000

|

|

Division of firm’s loss of ` 1,45,000 in 2 : 2 : 1 (Dr.)

|

58,000

|

58,000

|

29,000

|

1,45,000

|

|

Adjustment for Manager’s Commission :

10/110 of `2,20,000 = `20,000 in 2:2:1

|

(Dr.) 34,000

|

(Cr.) 17,000

|

(Cr.) 17,000

|

|

|

(Dr.) 8,000

|

(Dr.) 8,000

|

(Dr.) 4,000

|

20,000

|

|

Net Effect

|

(Dr.) 42,000

|

(Cr.)

9,000

|

(Cr.) 13,000

|

(Cr.) 20,000

|

RECTIFYING ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr.( `)

|

Cr.( `)

|

|

|

A’s Current A/c Dr.

To B’s Current A/c

To C’s Current A/c

To Manager’s Commission Outstanding A/c

(Adjustment for omissions of salary, interest on capitals and manager’s commission)

|

|

42,000

|

9,000

13,000

20,000

|

SOLUTION : 45.

TABLE SHOWING ADJUSTMENTS

|

|

Suresh

|

Ramesh

|

Total

|

|

|

`

|

`

|

`

|

|

Interest on Capital (Cr.)

|

45,000

|

30,000

|

75,000

|

|

Salary (Cr.)

Profit remaining after allowing interest on capital and salary’ will be `2,34,000 – `75,000 – `84,000 = `75,000. It will be divided in their profit sharing ratio, i.e. 3 : 2

|

60,000

|

24,000

|

84,000

|

|

45,000

|

30,000

|

75,000

|

|

Net amount which should have been received (Cr.)

|

1.50,000

|

84,000

|

2,34,000

|

|

Less : Profit already distributed equally (Dr.)

|

1,17,000

|

1.17,000

|

2,34,000

|

|

Net Effect

|

(Cr.) 33,000

|

(Dr.) 33,000

|

|

ADJUSTMENT ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr.( `)

|

Cr.( `)

|

|

2007 March 3 1

|

Ramesh’s Current A/c Dr.

To Suresh’s Current A/c

(Adjustment for interest on Capital, salary and wrong distribution of profit)

|

|

33,000

|

33,000

|

SOLUTION : 46.

STATEMENT OF ADJUSTMENT

|

|

A

|

B

|

C

|

Total

|

|

|

`

|

`

|

`

|

`

|

|

Salary to C

|

—

|

—

|

1,20,000

|

1,20,000

|

|

Interest on Capitals @ 5% p.a.

|

25,000

|

12,500

|

12,500

|

50,000

|

|

Balance profit i.e.

`3,30,000 – `1,20,000 – `50,000 = `1,60,000 distributed among partners in the ratio of 2 : 1 : 1

|

80,000

|

40,000

|

40,000

|

1,60,000

|

|

Net amount which should have been

received (Cr.)

|

1,05,000

|

52,500

|

1,72,500

|

3,30,000

|

|

Less : Profit already distributed (Dr.)

|

1,10,000

|

1,10,000

|

1,10,000

|

3,30,000

|

|

Net Effect

|

(Dr.) 5,000

|

(Dr.) 57,500

|

(Cr.) 62,500

|

.

|

ADJUSTMENT ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr.( `)

|

Cr.( `)

|

|

2016

March 31

|

A’s Capital A/c Dr.

B’s Capital A/e Dr.

To C’s Capital A/c

(Adjustment for the omission of Salary and interest on Capital)

|

|

5,000

57,500

|

62,500

|

SOLUTION : 47.

STATEMENT OF ADJUSTMENT

|

|

A

|

B

|

C

|

Total

|

|

|

`

|

`

|

`

|

`

|

|

Interest on capital

|

5,000

|

10,000

|

1 5,000

|

30,000

|

|

Salary

Commission : (5% on `3,60,000 – Interest on Capital `30,000)

Remaining Profit i.e. `3,60,000 – `30,000 – `60,000 – `16,500 = `2,53,500 will be divided in their profit sharing ratio i.e. 2:3:5

|

60,000

50,700

|

76,050

|

16,500

1,26,750

|

60,000

16,500

2,53,500

|

|

Net amount which should have been received (Cr.)

|

1,15,700

|

86,050

|

1,58,250

|

3,60,000

|

|

Less : Profit already distributed in 1 : 2 : 3 (Dr.)

|

60,000

|

1,20,000

|

1,80,000

|

3,60,000

|

|

Net Effect

|

(Cr.) 55,700

|

(Dr.) 33,950

|

(Dr.) 21,750

|

—

|

ADJUSTMENT ENTRY

|

Date

|

Particulars

|

L.F.

|

Dr.( `)

|

Cr.( `)

|

|

2014

March 31

|

B’s Capital A/c Dr.

C’s Capital A/c Dr.

To A’s Capital A/c

(Adjustment for the omissions)

|

|

33,950

21,750

|

|

|

|

55,700

|

SOLUTION : 48.

TABLE SHOWING ADJUSTMENTS

|

|

A

|

B

|

C

|

Total

|

|

|

|

`

|

`

|

`

|

`

|

|

|

Salary (Cr.)

|

6,000

|

6,000

50,000(1)

|

|

12,000

|

|

|

Commission (Cr.)

|

|

18,000

|

18,000

|

|

|

Profit guaranteed to B (Cr.)

Remaining Profit i.e. `1,50,000 – `12,000 – `18,000 – `50,000 = `70,000 will be divided between A and C in 3 : 2 (Cr.)

|

|

|

50,000

|

|

|

|

|

|

42,000

|

—

|

28,000

|

70,000

|

|

|

(Cr.)

|

48,000

|

56,000

|

46,000

|

1,50,000

|

|

|

Less : Profit already distributed

|

|

|

|

|

|

|

(`1,50,000 in 2 : 2 : 1) (Dr.)

|

60,000

|

60,000

|

30,000

|

1,50,000

|

|

|

Net Effect

|

(Dr.)

|

(Dr.)

|

(Cr.)

|

—

|

|

|

|

12,000

|

4,000

|

16,000

|

|

|

Adjustment Entry :—

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

2016 March 31

|

A’s Capital A/c Dr.

B’s Capital A/c Dr.

To C’s Capital A/c

(Adjustment for omissions)

|

|

12,000

4,000

|

16,000

|

Working Note:

(1) Profit remaining after allowing salary and commission will be

`1,50,000 – `12,000 – `18,000 = `1,20,000

B’s Share = 1,20,000 x 3/8 = `45,000.

Since it is less than guaranteed amount of `50,000, he will be entitled to `50,000.

SOLUTION : 49.

TABLE SHOWING ADJUSTMENT

|

|

X

|

Y

|

Z

|

Total

|

|

|

`

|

`

|

`

|

`

|

|

Interest already credited @ 8%

|

16,000

|

12,000

|

10,000

|

38,000

|

|

Interest that should have been credited @ 10%

|

20,000

|

15,000

|

12,500

|

47,500

|

|

Partners less credited with (Cr.)

By allowing this interest, the profits of the firm will be reduced by `9,500. This loss will be divided in the ratio of 5:3:2. (Dr.)

|

4,000

|

3,000

|

2,500

|

9,500

|

|

4,750

|

2,850

|

1,900

|

9,500

|

|

Net effect

|

(Dr.)

|

(Cr.)

|

(Cr.)

|

—

|

|

750

|

150

|

600

|

|

Adjustment Entry :—

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

2014 March 31

|

X’s Current A/c Dr.

To Y’s Current A/c

To Z’s Current A/c

(Interest less charged on capital, now rectified)

|

|

750

|

150

600

|

SOLUTION : 50.

TABLE SHOWING ADJUSTMENT

|

|

A

|

B

|

C

|

Total

|

|

|

`

|

`

|

`

|

|

|

Interest already credited @ 10%

|

10,000

|

20,000

|

30,000

|

60,000

|

|

Interest that should have been credited @ 9%

|

9,000

|

18,000

|

27,000

|

54,000

|

|

Partners Over credited with (Dr.)

By disallowing this interest, the profits of the firm will be increased by `6,000. This profit shall be divided in the ratio of

4:3:3 (Cr.)

|

1,000

|

2,000

|

3,000

|

6,000

|

|

2,400

|

1,800

|

1,800

|

6,000

|

|

Net effect

|

(Cr.)

1,400

|

(Dr.)

200

|

(Dr.)

1,200

|

—

|

Adjustment Entry:—

|

Date

|

Particulars

|

L.F.

|

Dr. (`)

|

Cr. (`)

|

|

2014 March 31

|

B’s Current A/c Dr.

C’s Current A/c Dr.

To A’s Current A/c

(Interest on Capitals excessive charged, now rectified)

|

|

200

1,200

|

1,400

|

SOLUTION : 51.

TABLE SHOWING ADJUSTMENT

|

|

A

|

B

|

C

|

Total

|

|

|

`

|

`

|

`

|

`

|

|

Interest allowed on Capitals @ 5% p.a.

|

Dr.

|

Dr.

|

Dr.

|

|

|

For the year 2016

|

4,200

|

2,400

|

1,320

|

7,920

|

|

For the year 2017

|

4,320

|

2,520

|

1,320

|

8,160

|

|

Total amount recoverable from partners (Dr.)

|

8,520

|

4,920

|

2,640

|

16,080

|

|

Division of firm’s profit will be as under:

|

Cr

|

Cr.

|

Cr.

|

|

|

For the year 2016 in the ratio of 2 : 2 : 1

|

3,168

|

3,168

|

1,584

|

7,920

|

|

For the year 2017 in the ratio of 3 : 4 : 3

|

2,448

|

3,264

|

2,448

|

8,160

|

|